The smart Trick of Tulsa Ok Bankruptcy Specialist That Nobody is Talking About

The smart Trick of Tulsa Ok Bankruptcy Specialist That Nobody is Talking About

Blog Article

Tulsa Bankruptcy Legal Services Things To Know Before You Get This

Table of ContentsBankruptcy Attorney Tulsa for DummiesAbout Bankruptcy Lawyer TulsaIndicators on Affordable Bankruptcy Lawyer Tulsa You Need To KnowSome Known Details About Chapter 7 Bankruptcy Attorney Tulsa 10 Easy Facts About Bankruptcy Attorney Near Me Tulsa Shown

The statistics for the various other primary type, Chapter 13, are also worse for pro se filers. (We damage down the distinctions in between the 2 types in deepness listed below.) Suffice it to state, speak to an attorney or more near you who's experienced with insolvency law. Below are a few sources to locate them: It's easy to understand that you may be hesitant to pay for a lawyer when you're already under significant monetary stress.Several attorneys likewise supply totally free examinations or email Q&A s. Take benefit of that. Ask them if bankruptcy is undoubtedly the ideal option for your situation and whether they think you'll certify.

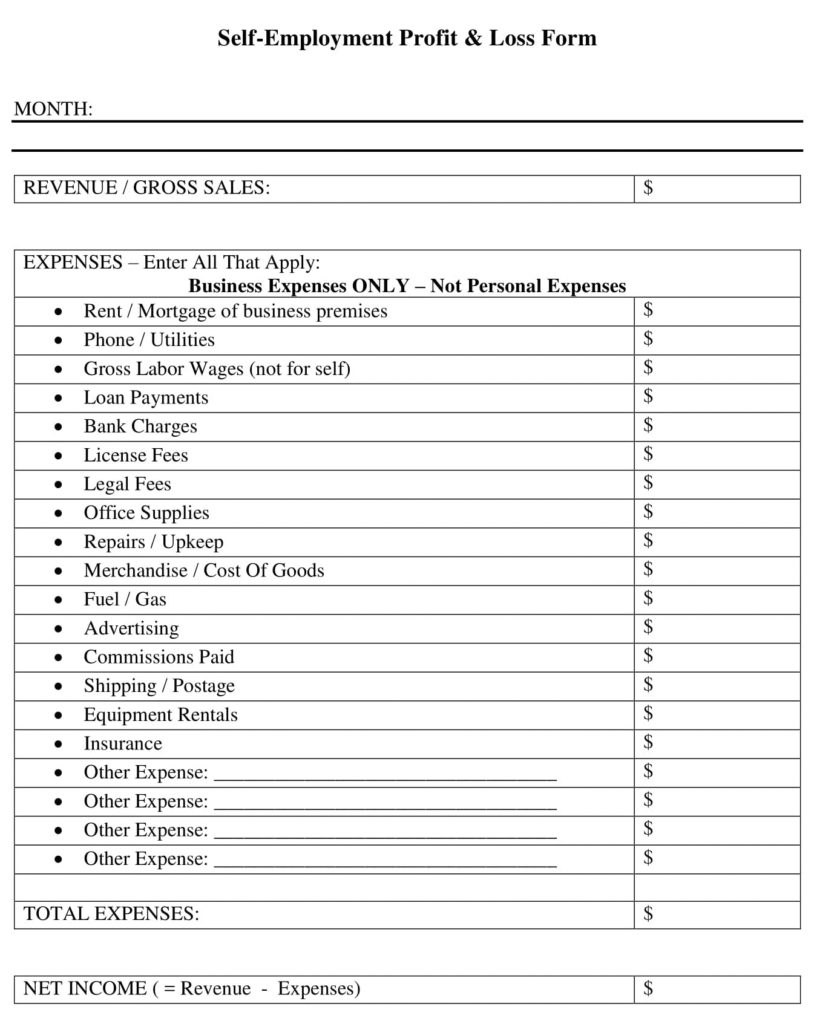

Advertisements by Money. We may be made up if you click this advertisement. Ad Currently that you have actually decided insolvency is certainly the right strategy and you ideally cleared it with an attorney you'll need to begin on the documentation. Before you study all the official insolvency types, you need to obtain your own records in order.

Tulsa Bankruptcy Lawyer Fundamentals Explained

Later down the line, you'll in fact require to show that by revealing all kinds of details regarding your economic affairs. Below's a fundamental listing of what you'll need when traveling ahead: Determining files like your chauffeur's permit and Social Safety card Tax returns (up to the previous 4 years) Evidence of revenue (pay stubs, W-2s, self-employed profits, revenue from properties in addition to any revenue from federal government advantages) Financial institution declarations and/or retired life account declarations Evidence of worth of your possessions, such as automobile and property evaluation.

You'll want to comprehend what type of debt you're trying to settle.

You'll want to comprehend what type of debt you're trying to settle.If your income is too expensive, you have an additional option: Phase 13. This alternative takes longer to solve your debts since it calls for a lasting repayment plan generally three to 5 years before several of your remaining financial debts are cleaned away. The declaring procedure is additionally a great deal extra complex than Chapter 7.

The Best Guide To Best Bankruptcy Attorney Tulsa

A Chapter 7 personal bankruptcy remains on your credit history report for ten years, whereas a Phase 13 insolvency falls off after 7. Both have enduring effects on your credit report, and any kind of new financial debt you secure will likely feature higher rate of interest. Before you submit your bankruptcy kinds, you should initially complete a required program from a credit rating counseling firm that has actually been authorized by the Department of Justice (with the notable exemption of filers in Alabama or North Carolina).

The program can be completed online, face to face or over the phone. Courses usually set you back between $15 and $50. You have to finish the course within 180 days of declaring for personal bankruptcy (Tulsa bankruptcy attorney). Make use of the Division of Justice's internet site to discover a program. If you stay in Alabama or North Carolina, you need Tulsa bankruptcy attorney to select and complete a program from a list of separately accepted carriers in your state.

The 30-Second Trick For Tulsa Ok Bankruptcy Attorney

Check that you're filing with the correct one based on where you live. If your irreversible house has moved within 180 days of filling up, you should submit in the area where you lived the better portion of that 180-day duration.

Typically, your bankruptcy attorney will certainly deal with the trustee, yet you may need to send the individual documents such as pay stubs, tax obligation returns, and savings account and charge card statements directly. The trustee that was simply appointed to your situation will quickly establish up a required meeting with you, known as the "341 conference" because it's a requirement of Area 341 of the united state

You will certainly need to offer a timely list of what qualifies as an exemption. Exemptions might use to non-luxury, main automobiles; required home goods; and home equity (though these exemptions regulations can vary extensively by state). Any kind of home outside the list of exemptions is thought about nonexempt, and if you don't offer any checklist, then all your building is taken into consideration nonexempt, i.e.

You will certainly need to offer a timely list of what qualifies as an exemption. Exemptions might use to non-luxury, main automobiles; required home goods; and home equity (though these exemptions regulations can vary extensively by state). Any kind of home outside the list of exemptions is thought about nonexempt, and if you don't offer any checklist, then all your building is taken into consideration nonexempt, i.e.The trustee wouldn't offer your cars to quickly pay off the creditor. Instead, you would certainly pay your financial institutions that quantity throughout your layaway plan. A typical misunderstanding with bankruptcy is that when you file, you can stop paying your debts. While bankruptcy can assist you erase a number of your unsecured financial obligations, such as overdue clinical expenses or personal car loans, you'll desire to keep paying your regular monthly payments for secured debts if you want to keep the residential property.

The Best Guide To Best Bankruptcy Attorney Tulsa

If you go to danger of repossession and have worn down all various other financial-relief alternatives, after that applying for Chapter 13 might delay the foreclosure and conserve your home. Ultimately, you will certainly still require the revenue check out the post right here to continue making future home mortgage repayments, in addition to settling any late payments over the course of your settlement plan.

The audit could postpone any debt alleviation by several weeks. That you made it this far in the process is a suitable indication at least some of your debts are qualified for discharge.

Report this page